The EU Large Combustion Plant Directive (LCPD) required polluting power plants to either “opt in”, become clean, or “opt out”. While German plants opted in, many UK plants opted out, meaning that they have to close by 2015 or 20 000 operating hours (from 2008), whichever comes first.

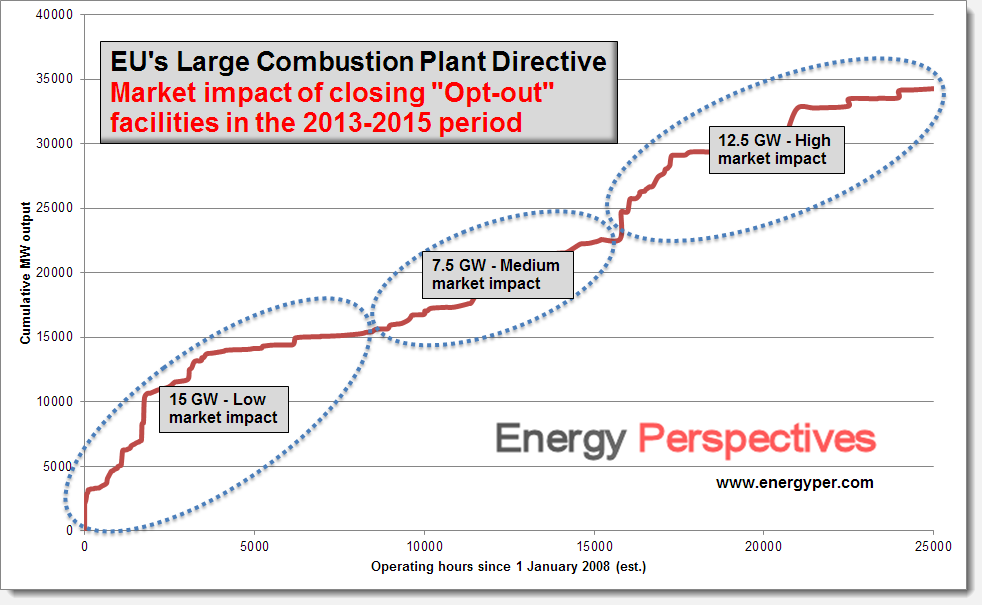

In 2013, the UK has closed about 5 GW of coal-fueled power generating capacity, to be followed by another 2 GW in the rest of 2013 and 2014. All plants have or will have reached the upper limit to operating hours. It is likely that there will be important implications for the power market and for the natural gas market. Our assessment of the 35 GW closures required under the LCPD by 2015, shows that about 12.5 GW capacity will have high market impact, and another 7.5 GW medium market impact.

LNG having been diverted – arbitraged – to Asia in the last two winters, will have to “come home” again to be used in natural gas power generating plants – CCGTs. Over the next year, to replace closed or closing impact high plants, more than 5 BCM/yr of additional natural gas may be required.

European CO2 emission permit prices may decline from an already low level, as possibly also coal prices, but natural gas prices will strengthen. The difficult time for natural gas in the European power market is therefore not over, but depending on the gas availability situation next winter, our price assessment and global LNG trading model suggest that gas prices will strengthen in several markets. Contact us for further information.