We just updated an Eikland Energy snap analysis of implications of US OFAC sanctions on the Portovaya and Vysotsk LNG plants near St. Petersburg, Russia and reproduce its key elements here as it links to earlier assessmens of 2023 sanctions on ALNG2 and market impacts.

> New US Sanctions on LNG targeting Portovaya and Vysotsk

10 days after Biden’s Executive Order (E.O.) 14024, sanctioning the Gazprom Portovaya and Cryogas Vysotsk LNG plants, Trump yesterday did not reverse these or earlier sanctions on Russian LNG. The associated Russian Harmful Foreign Activities Sanctions Regulations, 31 CFR part 587, GENERAL LICENSE NO. 117 authorized a reprieve for business wind-down until January 27, 2025, but subject to any payment being made into a blocked account in accordance with the Russian Harmful Foreign Activities Sanctions Regulations, 31 CFR part 587 (RuHSR).

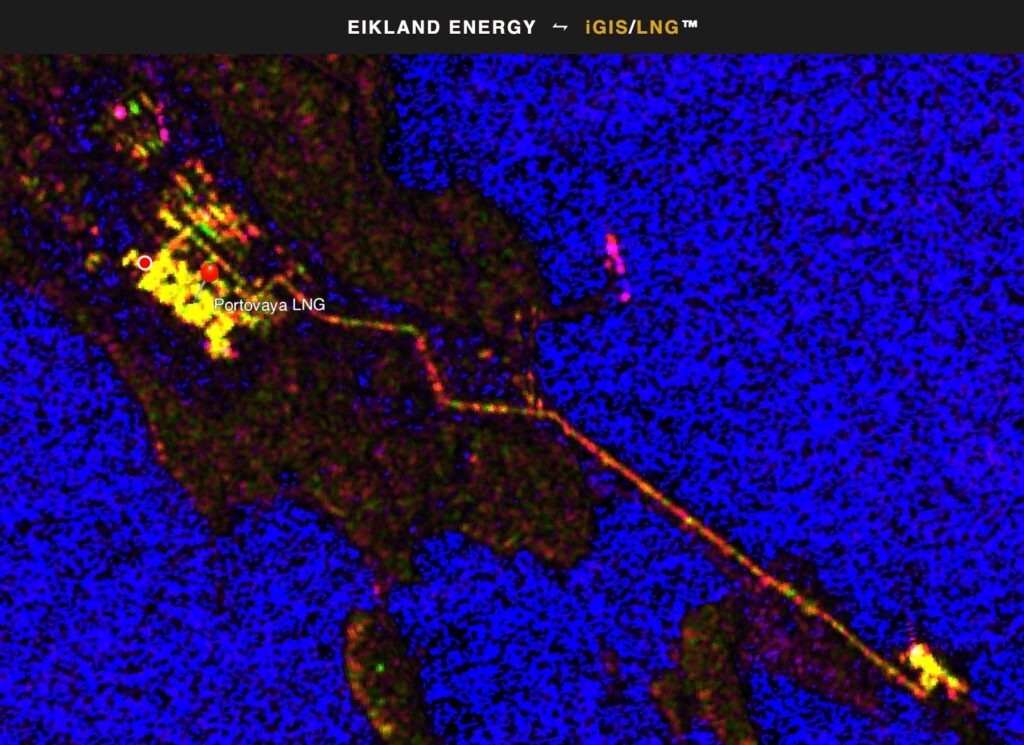

> Portovaya status on January 21, 2025

As of January 20, both 1.0 mtpa trains at Portovaya were still producing (contact us for details.) Of the three ships:

- Thenamaris-owned, Gazprom-chartered Cool Rover unloaded its Portovaya LNG cargo at Huelva, Spain on January 15. It has idled off Huelva since.

- Pskov discharged at Marmara Ereglesi, Turkey on December 30. It is now in the English Channel, apparently aiming for a return to the Baltic Sea and Portovaya.

- Velikiy Novgorod reloaded on January 12 after returning from Jiangsu, China and is idling off Portovaya awaiting orders.

> Vysotsk status on January 21, 2025

As of January 20, both 0.45 mtpa trains at Vysotsk were also still producing. Three medium/shall ice-classed LNG ships, all owned by Dutch Anthony Veder, now serve Vysotsk:

- Coral Evolution discharged at Zeebrugge on January 16. It has now stopped at the traditional central Bay of Finland anchorage location.

- Coral Fungia discharged at Zeebrugge on January 19 and is now off Skagen stating Vysotsk as its destination on January 23.

- Coral Nordic also discharged at Zeebrugge, on January 20 but has not yet left port.

> Sanctions Impact

Europe risks losing at least 2 mtpa of LNG supply due to the new January 10 US ‘OFAC’ sanctions. From the experience with Novatek’s Arctic LNG 2 (ALNG2), we believe there is a good reason to assume that the Portovaya and Vysotsk plants will ultimately be forced to stop due to a lack of LNG buyers and temporary storage. With Novatek’s futile ship loadings at ALNG2 from August 1 to October 5, how long will Gazprom and Cryogas/Novatek hope for buyer offtake and continue LNG ship loadings despite sanctions?

In contrast with ALNG2, there is no Floating Storage Unit (FSU) available for Vysotsk to store the LNG until sanctions are lifted. As a very short-term measure, the stationary Portovvy FSU at Portovaya and the Marshal Vasilevskiy FSRU at Kaliningrad may temporarily assist Portovaya. Theoretically, the Gazprom-ordered tank at Zeebrugge could be an option, but will in any event drop out due to the coming EU LNG transshipment ban.

Fundamentally our estimate is that Vysotsk will first be forced to stop, followed by Portovaya before the end of February 2025.

> Replacement LNG

Due to the relatively large gas volumes involved for Europe, in the 2-3 BCM/yr equivalent range, the LNG shortage can become especially acute for Portovaya buyers in Spain and for Vysotsk buyer(s) in Zeebrugge. Replacement supplies are likely already in the works, however. Vysotsk LNG has also been delivered to Manga, Finland, and Nynäshamn, Sweden, but alternative solutions may be easier to secure there using Inkoo, Zeebrugge, or Klaipeda as break-bulk transshipment sources.

> Conclusion?

As we come off winter, reduced heating demand and more than 10 mtpa increased and flexible supply over the next few months, including Plaquemines, Corpus Christi and Tortue, should help fill the LNG gap created by the January 10 OFAC sanctions. However, with additional storage fill requirements and the January 1 loss of nearly 40 mcm/d Russian gas transit via Ukraine/Sudzha there will be competition. Interestingly, the cease fire between IDF and Hamas this past weekend may even reopen gas exports from Israel to Egypt and thereby reduce Egypt’s LNG import requirements.

In this complex world we will not be surprised, even expect, that sanctioned Russian LNG assets; at the core Portovaya, Vysotsk and ALNG2, enter as chips if a basis for discussions about peace in Ukraine can be established at some point during 2025 or 2026.