Oil price cycles can be identified and should be used in planning

Business cycles have always fascinated human minds, and with the decline in oil prices interest in cycle theory has again surged. The key questions are when and how high prices will rise again.

Business cycle analysis inherently focus on change points, but often lack industry knowledge and do not show cause-effect relationships. “Fundamental” analysis, on the other hand, time after time fail to predict both turning points and the degree of change, systematically overshooting or undershooting. This note argues that oil price forecasting using detectable cycles has qualities that useful for business planning.

In 1912, when cars replaced horses in a “creative destruction”, Austrian economist Joseph Schumpeter brought focus to the 60-70 year Kondratieff technology cycle. Many other, shorter cycle types and harmonics have since been analyzed, several with far more explanatory power than the Kondratieff cycle, such as the Kuznets, Juglar and Kitchin cycles.

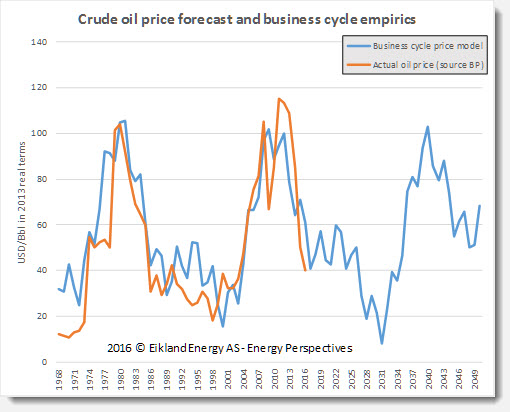

As part of a strategy scenario development case, Eikland Energy – Energy Perspectives research found that a cycle-based model had a strong fit to annual historical oil prices over nearly 50 years. The chart below shows the historical oil-price simulation along with the price extrapolation from this model to year 2050.

The relatively simple model combines three harmonic cycles, the Kuznets, Juglar and Kitchin cycles with ca. 20%, 30% and 50% weights, respectively. The model was formally tested against five key requirement for usability and forecasting confidence, with strong results:

- good overall statistical fit,

- convincing ability to capture both trend and short-term movements,

- major deviations must be explainable (e.g. OPEC actions),

- parameter values cross-checked against other studies and reasonability,

- parsimoniousness, i.e. a small number of model parameters and inputs.

A strong fit is never sufficient for confidence in a model, and its qualities must be seen in context of its intended use. Compared to the systematic under/overshooting of fundamental supply/demand and price models (e.g. from the International Energy Agency) the price cycle model adds something new and valuable.

It is notable that the model “explains” the long period of low prices in the 1990s and also picks up small annual aberrations from the overall price movement. The effect of OPEC price and market share strategies can also be assessed.

The model results show that the low-price phase seen in the 1990s has appeared again. The low price period started in 2014, giving price fluctuations between 40 and 60 USD/Bbl (2013 dollars) for 10 years, extended with a deep trough towards 2030 before improvement. Only after 2030 does the model show a significant and rapid price rise.

The scenario posits that oil company investment environment will be tough far longer than most analysts currently assume. Extremely low prices are not likely to persist in the short- and medium term; at least if OPEC and allied producers do not overproduce to protect market-shares.

The scenario adds important, quantified perspectives with implications for supply and demand, energy company strategic planning and resource policy. These perspectives should be essential additions to traditional fundamentally-based scenarios.

Please contact Kjell Eikland at +47-99517555 or kjell.eikland@eiklandenergy.com for further information.