On Europe´s gas storage situation, role in price determination, and winter price outlook

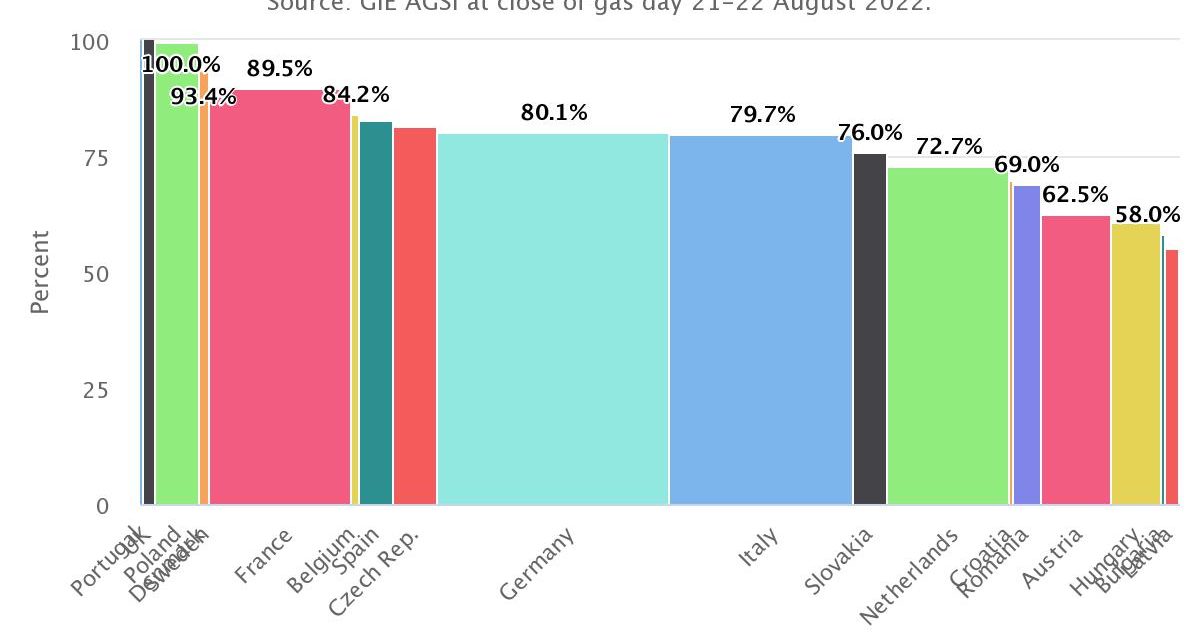

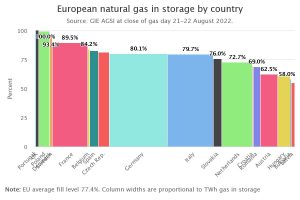

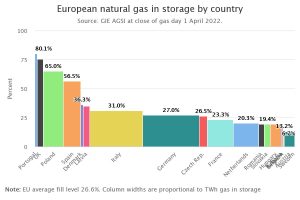

The EU is poised to reach 80% average gas storage fill level this week, and at the current injection rates even 90% by 1 October. The more than 50% storage level rise in the largest countries since 1 April is impressive. By now rapidly approaching full storages there, injections in the more exposed Austria and Hungary could also be strengthened to meet the EU-mandated 1 November minimum level of 80%. In addition, the Netherlands, Latvia, Estonia, and Finland will benefit from enhanced gas availability when three new LNG FSRU sites are commissioned in Q4.

Winter demand will typically see spikes starting early or late in December, and by this time storages will be able to provide required extra supply. LNG regasification will also be able to supply important further short-term deliverability. Current storage fill trends also mean that a further deterioration of pipeline gas supplies from Russia can be met in a more conventional managed way. In fact, even in the event of a “Napoleonic” winter we believe increased deliverability from LNG regasification terminals and supply from Germany´s four new FSRUs coming in in Q1 can cover winter tail demand as conventional storage is drawn down.

On the natural gas side, Europe therefore now seems as prepared it can be for the coming winter. However, there are several factors that have capacity to sustain uncertainty and high price levels.

Uncertainties regarding supply from Yamal LNG has had little public attention compared to the Nordstream pipelines. While we believe that Novatek will do its utmost to maintain production, not the least because of the sizeable 3 mtpa contract with China´s CNOC, forced outages are an increasing risk as scheduled maintenances are deferred due to sanctions. Trains 2 and 3 probably have the highest outage risks, i.a. because of compressors reaching running time limits.

Russia appears to now see an economically more vulnerable Europe and may be tempted to push even harder on gas supplies. This could also be extended from pipeline gas to LNG, where for example Yamal LNG contracts with companies in the West could be unilaterally voided. The recent Northern Searoute “convoy” test of four LNG carriers sailing together could even be seen as a precursor to this. Nevertheless, any Yamal LNG train curtailment has a larger possibility of being replaced by other sources than the reductions seen in Nordstream deliveries.

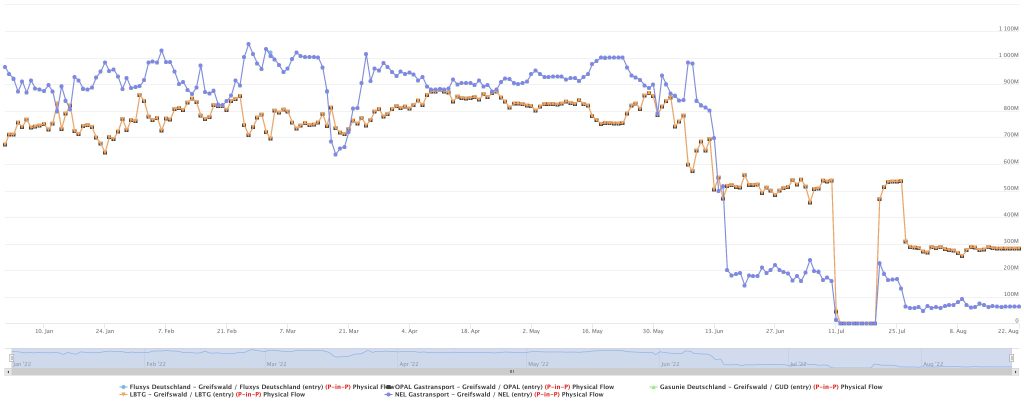

Despite the public focus on Nordstram gas flow curtailment, recent flow levels have broadly been consistent with the “one compressor available” statement and significantly helped Germany boost storage injection levels lately. It should also be clear to Russia that a repeat of the situation in January 2009, for either pipeline gas or LNG, will have lasting effects and could temper the most aggressive options.

In sum, we see current extremely high natural gas and power prices in Europe to a greater extent being pushed by forces outside of the fundamental natural gas balance in Europe, and a persistent market uncertainty. Sustained high LNG demand in Europe creates global competition, where the NBP has balanced with the JKM since before the summer, sets the high overall price level across the foreseeable horizon. However, the basis difference between the NBP and TTF is increasingly pushed by nuclear plant operating issues in France, uncertain renewables production (incl. low hydro reservoirs in Norway), slow restart of cold/reserve thermal power generating units, as well as EU´s general stronger economic dependence on Russia than the UK.

Our assessment is that there is now substantially less gas availability and gas balance risk than at the end of the past winter, but the market is extra tight for other, more “natural” reasons. We therefore see TTF natural prices likely to remain high, and set by the prevailing electricity balance prices, at least through the coming winter. On a positive note, with the improved gas storage situation and availability of LNG our assessment is of reduced risk of extreme winter TTF price spikes due to cold fronts.