This post has been extracted from independent work done during Q3 2023 by Eikland Energy AS advisory and presented here due to the general interest of the matter to the industry, and to shed light on the complicated issues involved. We note that the arbitration parties in the interim have submitted letters to the US+EU Task Force on Energy Security that was established in 2022, and that the views and positions presented there are largely reflected in our presentation here. However, our assessments should only be considered a general discussion of the key issues at stake and as timely case examples of these. Importantly, we understand that selected changes to contracting practices have already taken place.

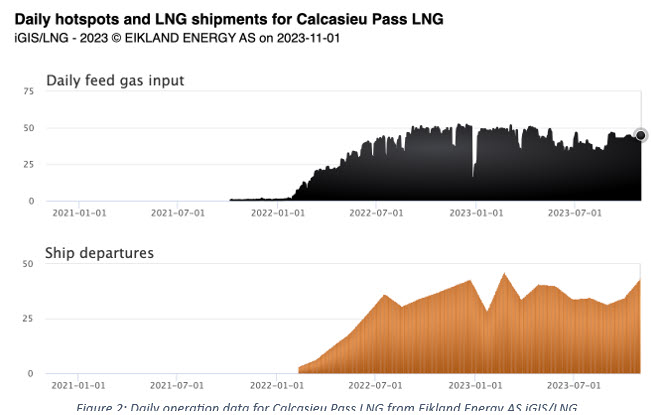

Five foundation capacity holders at the Calcasieu Pass LNG plant in Louisiana – Edison (Italy), 2xShell, BP, Repsol and GALP for 4+2 production blocks in development stages 1 and 2 – have not received any contracted LNG cargo for despite the plant producing at near capacity since production start in Q2 2022.

Instead, the owner-operator Venture Global has sold (and continues to sell) LNG cargoes via the spot market since March 2022, earning an average profit which may be on the order of 35 million USD per cargo, assuming an average net margin of 10 USD/MMBtu at market prices. Based on the 5.8 billion USD plant cost (600 USD/ton), we believe that these sales have allowed Venture Global to recover over 50% of its associated contract/block share of investments in a single year.

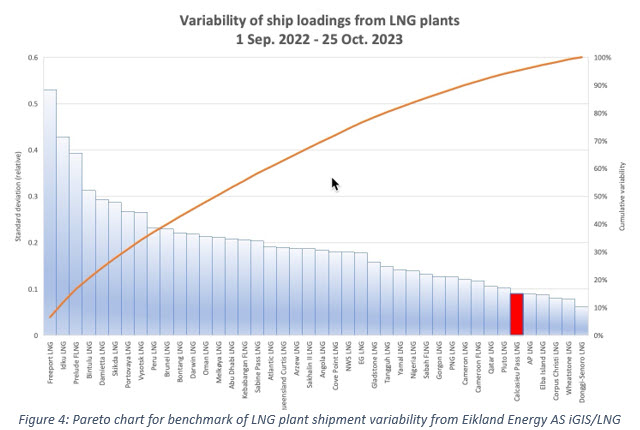

Venture Global continues to offer spot cargoes to the market into 2024 and argues that continuing technical problems prevent it from declaring the plant commercial, possibly until early 2025, giving a run-in period possibly longer than the plant construction time. However, Eikland Energy global LNG plant benchmark data shows that the Calcasieu Pass LNG plant is in the best quintile of plant regularity worldwide, with above 90% capacity utilization in the past year, despite the claimed technical problems. These observations are likely to be clear to the Calcasieu Pass LNG foundation buyers.

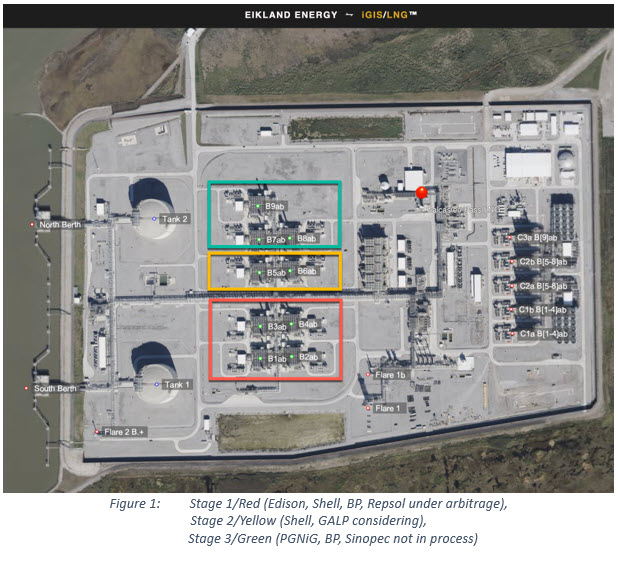

Venture Global’s actions have caused public and vitriolic disputes with Calcasieu Pass LNG foundation buyers. It is known that Edison, Shell, BP and recently Repsol – buyers of LNG from Stage 1, Blocs 1-4, have brough their cases to the London Court of International Arbitration (May-June 2023). GALP, who has a contract in Stage 2, Blocks 5-6 (together with Shell) is the least affected buyer, and stated (October 2023) it is actively considering the situation. The Stage 3, Blocks 7-9, with buyers PGNiG (Poland), BP and Sinopec (China), have only recently been authorized by the FERC to start operation and are therefore not yet affected, but be considering the matter.

An arbitration case for “breach of contract” will for Stage 1 buyers come down to a claim of non-delivery of LNG that the buyer(s) consider they are entitled to. While Calcasieu Pass LNG sales contracts are not public, the process to set first day of commercial operation is always highly regulated. A standard wording for a seller’s ultimate excuse for not setting a COD is that the train/block is “… (not) capable of delivering LNG in quantities sufficient and quality necessary to permit Seller to perform its obligations” (cfr. FERC/Corpus Christi LNG).

As we discuss, substantial and consistent exports of specification LNG at Calcasieu Pass LNG suggests otherwise. Observed output variations are small in aggregate and appear well covered by the 0.4 mtpa flexibility difference Venture Global has between block nameplate capacities of 1.4 mtpa and its commitment under the individual 1 mtpa contracts. In fact, it is standard contractual practice that LNG operators have such excess capacity to absorb operational risk on its account, but where it also has the flexibility to conduct spot sales.

The arbitration cases should in our view, and are likely to, consider both US DOE export permit formalities and the practical and legal content of the standard of a Reasonable and Prudent Operator (RPO), specifically when the seller can be deemed to be unreasonable and imprudent in relation to denying the buyers the product they wish under the contracts. Given the vitriol, the buyers clearly believe they are now experiencing Moral hazard, i.e. that the presumption of good faith between LNG contracting parties is being challenged and the behavior of the seller has changed after contract signing. There is therefore also an important question of intent.

Strong legal precedents from the oil & gas sector are likely to be brought to bear regarding the interpretation of expected behaviors under the RPO. Surprisingly few are available, but strong verdicts listing detailed criteria for expected behavior are given in these. Finally, there is context, background, and specific discussion in the US DOE blanket orders on 18 December 2020 permitting short-term LNG exports that could support a breach of contract claim.

Arbitration is chosen because cases typically can be solved faster, with more finality and confidentiality than in a court of law but can nevertheless take many months (up to a typical limit of 6 months). The challenge of multiple parallel, unsynchronized arbitration processes adds uncertainty about effectiveness, but there is typically a provision for consolidation of multiple claimants. However, even ahead of seeing the specific Calcasieu Pass arbitration outcomes, some leading LNG buyers are reviewing existing contracts and assessing risk-mitigating changes to standard terms in new contracts. In effect, buyers will be more reserved towards new suppliers and not assume (as the standard RPO definition implicitly does), that the interests of the seller and buyer are inherently aligned.

Foundation buyers’ right to early production is likely to be imperatively clarified in new contracts, with any owner spot sales explicitly residual to long-term sales. It will be a right of first refusal for the long-term contract holder if and only if the owner has not explicitly reserved any excess gas availability for itself. The RPO definition should also move towards more qualified trust, more audit and control, information, and involvement.

We expect most LNG sellers and buyers will consider these developments broadly for their contract portfolios and these will have more freedom to make useful changes as opportunities arise. However, the present “no-trust” environment between Venture Global and the buyers at Calcasieu Pass could be hard to solve and conflicts may possibly spill into other Venture Global projects, notably for Plaquemines LNG currently under construction.

Despite the strategic challenges for all parties, we believe there is support for arriving at good solutions for US projects rooted in both industry practice, and the mentioned background and discussion text of the 2020 US DOE blanket order authorizing spot LNG sales. In fact, if the matter regarding spot sales had been raised by the buyers in 2020, we suspect that a solution would have been found.

As it is, an aim to recover Calcasieu Pass foundation buyers’ loss of profit could be a major hurdle to resolving the principal objective of long-term buyers’ right of first refusal to spot LNG availability. This may have been a consideration why GALP as of October 2023 had not yet called for arbitration against Venture Global.

In any event, as Venture Global now appears to seek to have its conduct be considered a ‘normal’, if they have not already done so, all LNG buyers should consider these matters at least against counterparties with which they have had little prior experience.

Please contact Kjell Eikland at kjell.eikland@eiklandenergy.com if you wish to discuss this post and the associated detailed full analysis and case references.