-

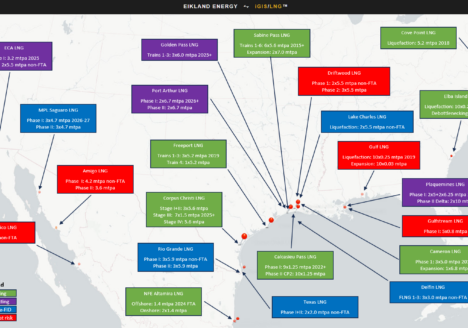

Eikland Energy Analysis: The U.S. DOE LNG export moratorium and a case for a 200 mtpa export ceiling

The announcement of a moratorium on the U.S. Department of Energy (DOE) awarding new LNG export permits (including extensions) on January 22, 2024, has stirred dissatisfaction among project developers and potential LNG…

2024-02-14 -

The merits of the 2023 arbitration cases against Venture Global at Calcasieu Pass LNG

This post has been extracted from independent work done during Q3 2023 by Eikland Energy AS advisory and presented here due to the general interest of the matter to the industry, and…

2023-12-08 -

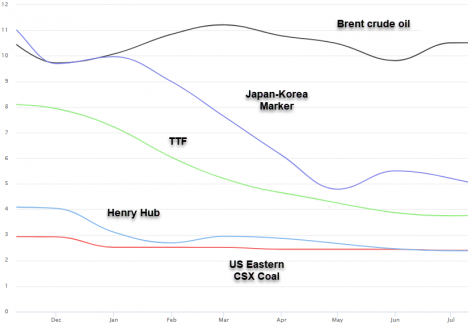

From Henry Hub plus to LNG netback pricing – The rapid change, background and implications for the LNG market – A pink-paper

In the spring of 2019 natural gas prices converged to marginal equality world-wide for the first time. This was due to sharp supplier competition with the backdrop of substantial new LNG production…

2019-06-16 -

Workable strategies for new US LNG projects

This note discusses the predicaments of US LNG projects as a result of new price and supply developments. Also, the attempts to help US LNG sales by political avenues are with few…

2019-05-12 -

Will US LNG export projects be pulled into a trade war?

Two years after startup of Cheniere’s Sabine Pass LNG, Dominion’s Cove Point finally produced its first LNG on 18 February (according to the iGIS/LNG gas analytics service), and loaded its first commissioning…

2018-03-02 -

An oil and gas industry letter home at the end of the year

“From Shell shock, to Total encore and the resolution of the strategic Enigma.” At the tail end of 2017, oil prices are back to a level where many think they should be,…

2017-12-21 -

“Time to talk ” – Oil prices 2016-2018

The December fall in global crude oil prices from 50 dollars to below 40 USD/Bbl, should it persist at this level, is more important than the fall from 100 dollars in 2014. …

2016-01-01 -

LNG prices and lateral thinking

Energy Perspectives recently did a 15-year forecast of Asian LNG prices for a client investment case. Certainly challenging, given the state of energy markets, oil prices, uncertainty of demand and an onslaught of…

2015-09-08 -

Panama Canal Charges for LNG and a Brave New World of Global Gas

After two years of discussions and lobbying by users, the Panama Canal Administration last week set the tariff schedule for LNG vessel passage. For the 175,000m3 LNG “PanaMax” vessel, the round-trip cost…

2015-05-06 -

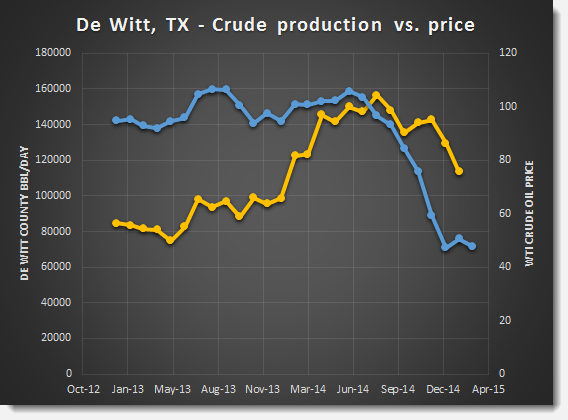

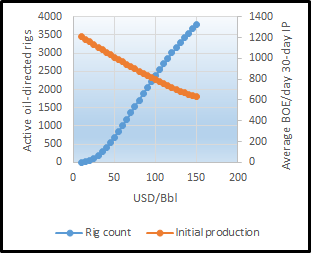

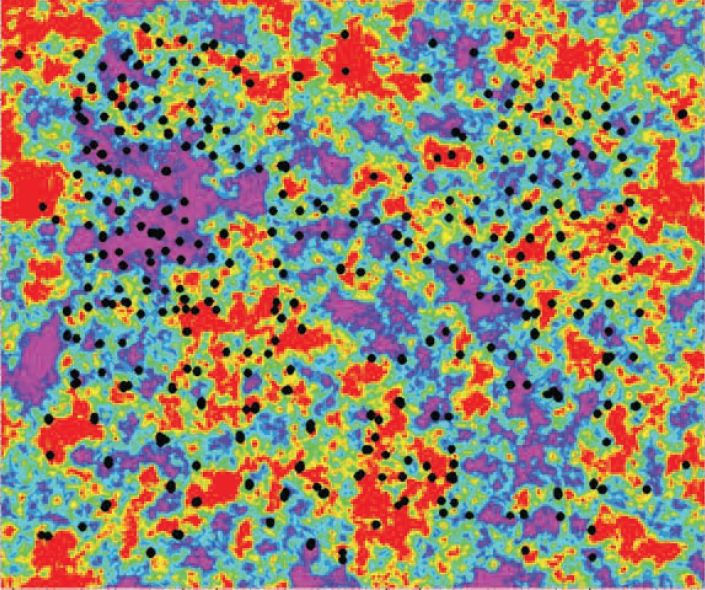

US shale oil contraction – Hard evidence for strategy and OPEC’s June 5 meeting

Crude oil prices have slowly increased over the past couple of months. The availability of solid US shale oil production data has been lacking, and many forecasts have maintained the incredible resilience of US…

2015-05-05 -

Has OPEC killed the shale oil Troll?

Another decline in the US oil rig count was reported on 17 April 2015 by BakerHughes, 26 rigs down. Overall, oil rig count is down by more than 50% since December, to 734.…

2015-04-20 -

US shale oil could drop by 0.5 mill. Bbls/day in 2015

At current oil prices, there is momentum for stabilization and then contraction of US shale oil production through 2015 and beyond. The full output reduction reflecting the new price level is estimated…

2015-02-17 -

Crude oil prices 2015 at 35 USD/Bbl – An avoidable worst-case scenario

This 23 December 2014 post (republished 23.January 2015 due to system restore) is a follow-up of our November comments on OPEC thinking and market strategy (its timestamp a republish due to a . …

2015-01-23 -

Energy Perspectives and iGIS/LNG – LNG World Summit, Paris 2014 D-1

The LNG World Summit 2014 takes place in Paris this week and we look forward to attending this important event. Risk management is a key topic. Energy Perspectives has now launched the…

2014-11-18 -

A Message from OPEC, the Real Oil Boss

In year 2005 investment bank Goldman Sachs famously asked “What does it take to stop China?” They answered the question themselves, an oil price of 105 USD/BBl. The growth in China did…

2014-10-17