Massive outstanding debts for Ukrainian natural gas imports from Russia, the Ukraine’s approchement to the EU, followed by Russia’s annexation of the Crimea and support of separatist forces in eastern Ukraine, have combined to give a geopolitical crisis. Many analysts have credited Vladimir Putin’s desire to rebuild the Soviet Union as the root cause of the crisis, and it is hard to see payment issues for Ukraine’s gas imports as a sufficient reason for the aggression.

We would point to additional factors that have received little public attention – the Ukrainian rich reserves of energy resources that have strikingly similar characteristics to US shale, to massive natural gas storage fields, and recent natural gas reverse flow supplies from Europe.

Shale resources

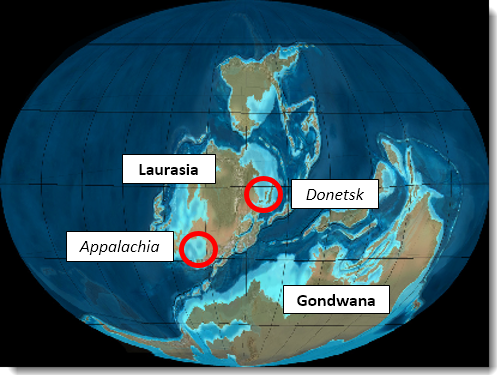

The US shale resource revolution is based on the exploitation of fossil sediments 380-440 million years ago. The world looked very different then, and much of organic deposits took place in the equatorial continent named Laurasia. The origin of today’s North American shale resources can be clearly identified in computer-generated maps for this period. Using our time-sequence animation of the outstanding maps from Professor Ronald Blakey, the links to modern Ukraine are revealed.

The Marcellus shale structures in Pennsylvania appear to match the deposits in the geological Eiffelean period in the coal basins of eastern Ukraine, but on different sides of the Arcadian mountain range. The geographical extent of the Marcellus and the underlying Utica basins in North-Eastern USA is approximately the same as that of Dnieper-Donets basin in the Ukraine, about 250 km wide and 500 km long.

While there has been very little deep geophysical mapping and exploration in these zones in the Ukraine, Russian geological maps point to Eiffelian shale resources in Eastern Ukraine of more than 100 meters thickness, deposited about 395 million years ago. While the likely gas-to-oil ratio is uncertain, parallels to Marcellus – and possibly Utica structures are strong. Rich evidence from Pennsylvania and Ohio point to exploitable resources that could potentially give an annual production of more than 50 BCM/year also in the Ukraine. If the unique Marcellus J1/J2 joint structure is also mirrored in the Ukraine shale, the production potential may even be significantly higher.

The Ukraine currently produces about 20 BCM/year (billion cubic meters) of natural gas from conventional sources (measured at the Russian standard at 20C). 85% of the production comes from the eastern Dnieper-Donets basin. This production is therefore highly exposed to insurgent actions in the area and potential Russian intervention. Planned shale exploration by some western companies, such as Shell, has been put on hold because of the current turmoil.

The current consumption of natural gas in the Ukraine is about 50 BCM/year, and if the Dnieper-Donets shale resource potential were to be confirmed and professionally exploited, it could potentially fully satisfy current Ukrainian domestic gas requirements. In fact, there are additional geological structures covering the Crimea, extending into the Black Sea that could be of interest. What could Russia’s thoughts be on this?

Major natural gas storage fields

In addition to the very significant shale-based natural gas prospects just mentioned, the Ukraine already has massive gas storage fields with 70-75 BCM of total working gas capacity, far larger than any other European country.

The key storage fields are Dashava and Bogorodchany in the Carpathians, but also several large sites in the east with 15-20 BCM of total working gas capacity. Shebelynka is among these, which also has producing structures.

Importantly, all of these sites, major by any international standard, are connected to the large 48” pipelines from the Yamal peninsula, transporting about 150 BCM/year of natural gas to western and other parts of eastern and southern Europe.

The giant Deshava 47 BCM storage near the Slovak import point, at Velke Kapusany, has in particular played a key role as a seasonal, operational and strategic buffer for Russian exports. The storage has made it possible to maintain even gas flows upstream, and to handle unforeseen interruptions. In addition, Deshava has been used to provide flexibility to handle variable seasonal demand in European markets, and more recently, has made it possible to exploit short terms trading opportunities.

Since 1990, the ability of Gazprom and Russia to flexibly use these resources has been significantly reduced. Yet, the opportunities and challenges that these assets represent could possibly also provide suggestions for solutions for the current conflict in the interest of all parties, including also the EU.

Reverse supplies

Recent focus on the Ukraine has been on the military situation, but EU approchement and security of energy supply concerns remain important backdrops. Following the severe 2009 Russian interruption of natural gas flows to Europe, regulation EU No 994/2010 was passed to urgently improve supply risk mitigation capability, and to implement internal EU reverse natural gas flow capability by 3.12.2013. Following this, by 2014 the ability to effectively extend reverse flow to also include the connection between Slovakia and the Ukraine was improved.

“Thanks to the opening of reverse supplies from Slovakia and the possibility of Ukraine buying gas in Europe, we replaced 40% of the gas that we earlier bought from Russian company Gazprom with gas that we buy and transport from Europe,” Ukrainian Prime Minister Arseniy Yatseniuk said at a ceremony to launch reverse gas supplies in Slovakia on 2.9.2014.

Energy Perspectives’ European gas flows analysis, using transmission companies’ data provided by Entsog, confirms a 40-50 MCM/d reduction in Russian exports to Europe, starting in July 2014. The EU has therefore started using its internal market to balance supply and demand in assistance of the Ukraine. (Incidentally, EU gas re-exports to the Ukraine by pipeline mirrors the recent extra LNG imports from Qatar to the UK, see our separate note on this in August.)

Russia clearly sees any redirection as a breach of “destination clauses”, or as a violation of the spirit of the gas contracts. The handling and responses to reverse flows will undoubtedly be important for any further escalation, the parties’ capabilities and expectations about the duration of the conflict.

* * *

Going into the winter of 2014/15, the current short-term supply solution may place significant stress on European gas balances should the Russian embargo of the Ukraine continue. Ukrainian winters can be extremely cold, and even the robust Ukrainian storages may have delivery problems or even be depleted if spring comes late. The overall energy balance going forward is therefore extremely precarious, amplified by possibly continuing insurgence in the east, which can lead to interruption of key domestic Ukrainian gas production and transportation.

While Russia may be tempted by the shale resources and storages in the Dnieper-Donets area, including similar prospects in the Crimea, their exploitation may be hampered by a long crisis. Importantly, the natural gas side alone highlights that a strategy of containment has a time limit for all parties. Russia’s fundamental interests would instead appear to be, to outsiders at least, a positive cooperation with the Ukraine, and for continued revenue-generating sales to the European markets.

Rather than persisting with the current stalemate and natural gas winter brinkmanship it must be hoped that the fundamentally joint commercial interests could help lead to a more constructive dialogue between the Ukraine, Russia and the West.