Japan Crude Coctail forever?

Asian interest in breaking the traditional link between LNG import prices and crude oil has been intense for several years. Initiatives to establish regional hubs and spot price indexes have until now largely failed. Trading is minimal and spot LNG prices mainly reflect near-term spot crude prices. How far away is Asia from developing price-defining LNG hubs?

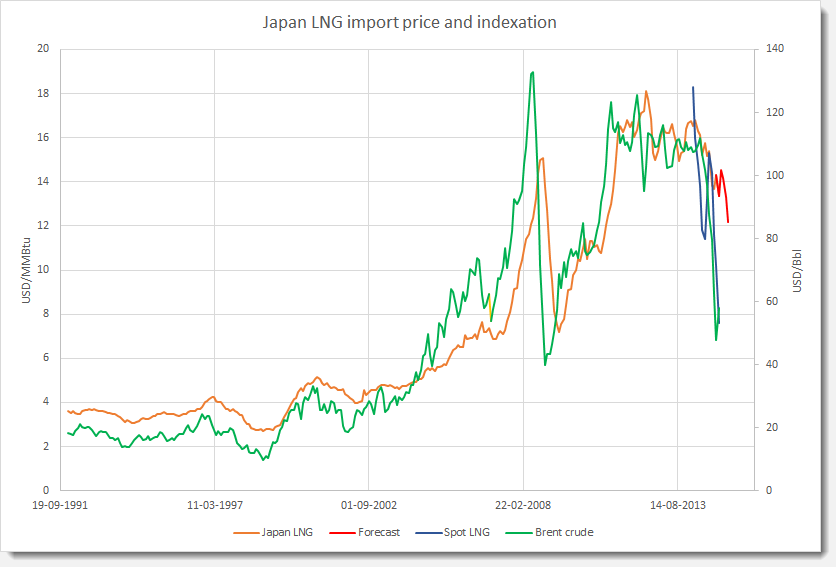

As the title chart shows, the average LNG import price to Japan has followed the crude oil price through thick and thin, aka. the Japan Crude Coctail or JCC. Dominated by long term contracts, LNG prices on average lag crude prices by a quarter. The monthly average spot LNG price to Japan, available since January 2014, shows a near 1:1 relationship to crude oil. The “percent of JCC” rule still holds.

In the US and Europe, liberalized natural gas markets developed on the basis of gas surplus, mature infrastructure and vertical open access for pipeline gas. LNG is still an non-liquid factor in these markets, even with a nominal secondary market for capacity in LNG terminals. A gas or LNG surplus is theoretical and not sufficient for market development if it is not available to traders, but “hoarded” by incumbents.

The obstacles to flexible LNG pricing to emerge in Asia are therefore formidable, amplified by timidness of market reforms and probably culture. There is not only a need for an open physical delivery platform with gas-to-gas and inter-fuel competition, but an end-to-end reform of commercial models.

Singapore aims to be an LNG trading hub, but significant flexible physical capacity will only be available from 2018. Japan is taking steps to open the power market from 2016, which could strongly affect LNG. Both South Korea and China are introducing market mechanisms in power. A combination of new wind, solar and hydro capacity create a rapidly growing need for flexibility. In parallel, new LNG supply and pipeline gas contracts contain significant sourcing and offtake flexibility with different price formulas.

The first true indication that change may be taking hold is when crude oil and LNG spot prices in Asia decouple over several weeks. As in Europe, it could take several rounds of legislative reforms and more than a decade to accomplish this in Asia. However, with its size and dependency on LNG, developments in the power market in Japan may for the first time put LNG in the front seat of a liberalization process. If successful, the power market may therefore become the virtualized LNG hub.

While early movers should beware, so should incumbents.