LNG prices and lateral thinking

Energy Perspectives recently did a 15-year forecast of Asian LNG prices for a client investment case. Certainly challenging, given the state of energy markets, oil prices, uncertainty of demand and an onslaught of Australian and US LNG projects! The real surprise, however, was how quickly lower oil prices have given fundamental changes in US gas price formation and global LNG contracting.

The spring of 2011 was not only marked by the Fukushima disaster and high Asian gas prices, but also a flood of natural gas from US shale gas. In the last year, both Asian natural gas and global oil prices have collapsed, turning energy logic on its head, again. US shale gas is suddenly challenged by price – and offtake is not ensured by take-or-pay.

A previously “unthinkable” scenario is therefore that a lack of international demand for US LNG puts pressure on already low domestic US gas prices. Recent experience from international oil and gas markets has powerfully shown that small volume imbalances of 2-3% can trigger fundamental price shifts. In aggregate, foreign gas buyers in US LNG export projects have already committed to more than 10% of US gas supply and therefore have sizable potential influence on price.

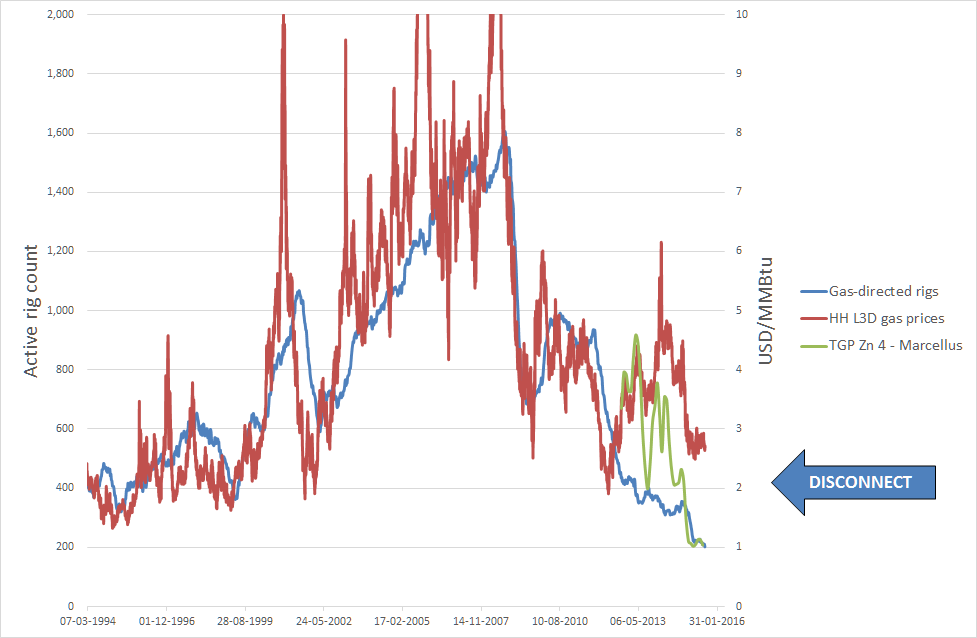

Studies supporting US LNG projects have argued that exports will not significantly increase long-term gas prices because the shale-based supply curve is so flat. Drilling is also very responsive to gas price changes, as the chart of gas-directed rig count vs. Henry Hub prices (the US gas marker) shows. However, a major disconnect appeared in 2012.

Henry Hub appears no longer to be the marginal price driver for gas-directed drilling in the US. The best-fit price index is TGP Zn 4 – Marcellus (i.e. Tennessee Gas Pipeline Company Zone 4, between compressors 315/319 and 321).

Conventional wisdom suggests that Marcellus prices will converge to Henry Hub prices as “take-away” pipeline capacity increases. The curves suggest otherwise and the Henry Hub price may actually be following Marcellus already. The major question is how declining transportation deltas will combine with market demand and price strengthening effects.

By our calculation US LNG has been “out of the money” from some time already based on Henry Hub. The net-back value of LNG from European markets to the US has since early 2015 already been best matched by the Marcellus price, suggesting a differential of 0.50 USD/MMBtu to Henry Hub.

From these new parities, US producers have in 2015 already signed LNG export deals with European NBP and TTF indexation. In the process, Europe’s balancing role is also on its way to be firmed up beyond spot trading.

The changes powerfully underline the dynamic world of LNG and natural gas pricing. The possibility that oil prices will again rise above 70 USD/Bbl is also a reminder of the need for contract flexibility and to be open to “lateral” scenarios.

Above all, as in the 1990’s, operational project price sensitivity testing may again be far more important than striving for the best single price forecast.