The US shale gas and LNG revolution has deservedly had the industry’s attention since year 2011. The massive push to realize the second wave of US LNG exports may effectively fizzle in 2019 because of final investment decisions (FIDs) in a series of quality non-US LNG projects.

“Projects that require buying commitments are really struggling to find buyers to sign up … I don’t know what the buyers are waiting for because the golden opportunity to sign up for deals was yesterday.” V. Chandra, CEO of Texas LNG, November 2018.

The assessment concludes that the potential second wave of US LNG projects is largely a reserve supply solution for the increasingly unlikely event that primary non-US projects are not realized. Underlying this situation is that traditional buyer behavior is fundamentally changing and that more oil & gas companies are working to develop more extensive mid- and downstream LNG assets and operations.

This strategy note summarizes the status with main figures, the situation of the industry, associated business strategies and implications ahead. (For more background and a recent review of industry developments also check “LNG in 2018 – A short Christmas story and market outlook”.)

Whence we came

The current wave of global LNG export projects being realized will increase liquefaction capacity by 100 mtpa (million metric tons per year) from around 300 mtpa in year 2018 to 400 mtpa in 2023. In year 2018 alone, 35 mtpa liquefaction capacity started up, and 90% will come on-stream by the end of 2020.

More than 60% are US LNG projects of the first wave where investment decisions were made between 2012 and 2015, producing first LNG from Cheniere’s Sabine Pass LNG in 2016.

Many other potential LNG projects world-wide did not survive the period with low oil prices 2015-2017, for example in Canada where projects were decimated. However, many have since been reworked and optimized at lower-cost. In addition, and a wave of new innovative projects has recently emerged along with the recovery of prices and continued strong LNG demand.

Oil & gas companies have now stabilized balance sheets and see strong profits from higher energy prices and cash-flow from new projects. This has enabled them to set priorities and more confident investment strategies for the next years. The focus on new non-US projects can in several cases also be regarded as a deeply founded strategic response.

Increased confidence has also reached LNG buyers, ship-owners and financial institutions. In addition, the supply industry is getting ready with available capacity for a substantial new construction round.

Where we are

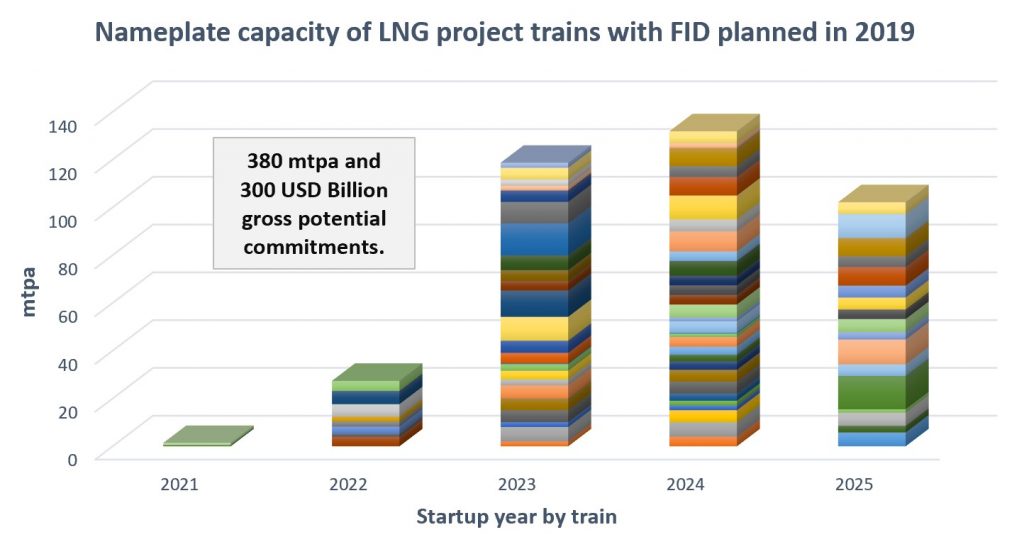

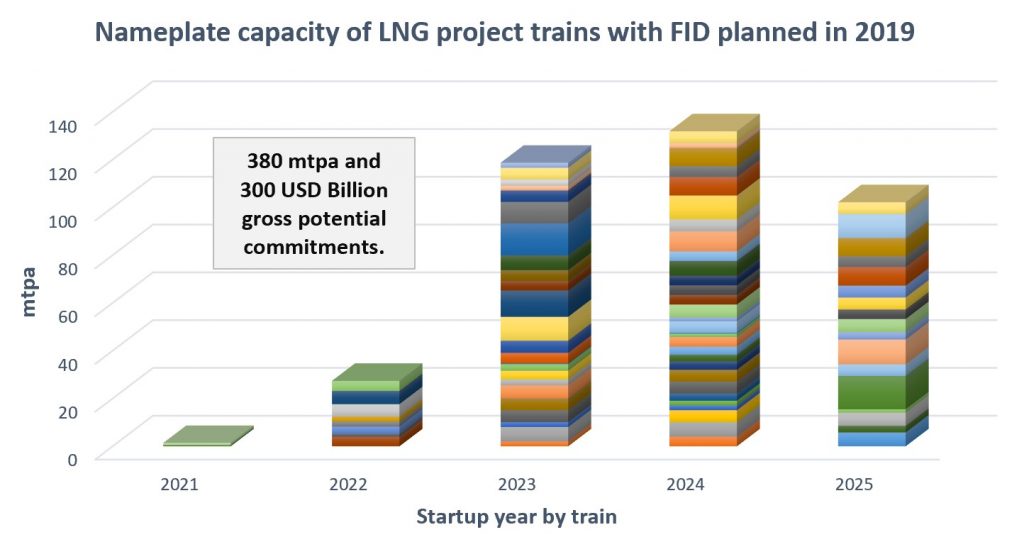

The Eikland Energy iGIS/LNG system and database shows a potential 380 mtpa of capacity from new LNG liquefaction projects, with an estimated gross investment value of 300 USD Billion. These are sought to be committed and realized over the next 6-7 years with a final investment decision (FID) concentrated on 2019.

There are 130 individual trains in the 0.5 to 8.4 mtpa range, with 50% of the volume and 69 trains in the US. No projects cancelled in the 2015-2018 period are included, such as many large Canadian LNG projects. The technical quality of the projects now signaled as ready for FID in 2019 is generally high. Unlike before the 2015 oil price fall, no project appears “frivolous.”

The projects have widely different commercial qualities, however. While many projects have strong owners and have secured long-term sales agreements with equally strong buyers, the income potential for others are only indicated by high-level market studies.

While it would also be improbable that the supply industry could deliver all these projects in the indicated time frame it is instructive that the resource base in no way limits rapid LNG market growth far beyond 2023.

Offtake assured

Global LNG demand currently grows at about 15 mtpa per year. This is equivalent to 3×5.0 mtpa new world-scale liquefaction trains (and about 20×170,000 m3 new LNG ships) every year.

However, the LNG demand picture is not uniform. LNG demand in Europe, Japan, Korea and Taiwan is relatively stable and may even sink. Most of the conventional demand increase depends on developments in China and south/central Asia, including India.

The LNG market will be roughly in supply-demand balance until year 2023 with projects that are currently under construction. The International Energy Agency sees LNG demand growth continue at least through year 2023, and several published oil company market outlooks point to continued growth to year 2035 (and even beyond 2040 in BP’s case.) These outlooks also help steer the oil companies’ long-term investment decisions.

Further, 2018 became the year when the market for LNG as bunker fuel replacement took off with a rush of new ship orders and projects creating the logistical system. IMO’s 2020 ECA deadlines and the extreme focus on reducing ship emissions ensure that this market will develop strongly. Estimates suggest that the LNG bunker and fuel oil replacement market can reach 50 mtpa, and with less demand uncertainty than conventional LNG. Importantly, oil & gas companies now take steps to distribute LNG to these segments from self-sourced portfolios, which for this reason must grow.

Roughly a third of annual incremental LNG demand in the years ahead is expected to come from China, indicatively requiring one new standard 5.0 mtpa liquefaction train per year. Based on current and planned regasification capacity alone, China can potentially absorb as much as 50 mtpa of additional LNG imports. India and several other Asian countries are also constructing significant new LNG import capacity that currently only partly have matching supplies.

With this positive demand outlook it will be necessary with a substantial generation of new LNG projects to match market growth (and some non-renewed expiring legacy contracts.)

Selecting supply projects

2019 will therefore be a year of project selection for new LNG supplies starting in 2023. Based on a continued LNG demand growth of 15 mtpa per year, a perspective to cover 10-years of reasonably assured demand growth will require around 150 mtpa of supplies from 30 new world-scale liquefaction plants. Far more LNG is on offer.

With 380 mtpa available from candidate projects the situation might be rather comfortable from a security of supply and market balance perspective. It is a major competitive situation where more than half of otherwise interesting supply alternatives will not be chosen.

The selection criteria are complex, but also extremely well known in the industry. International oil & gas project development uniformly follows a strict stage-gate phase model, which ensures a solid technical and commercial footing for projects reaching the FID stage. By this standard, many profiled US LNG projects are little more than qualified site options.

In fact, only 10-15% of liquefaction train capacity up for FID in 2019 is claimed to be secured by long-term third-party offtake agreements, while a further estimated 10% is backed by equity. The Mozambique projects, for example, led by oil & gas companies, follow the traditional contract model.

There is now little time and perhaps little buyer appetite, to convert HOAs to firm offtake agreements in time for the 2019 FID season. Other than Cheniere with its existing sites at Sabine Pass and Corpus Christi, the option to establish a merchant model appears not to have been pursued by US developers at all. Kinder Morgan at Elba Island and Spectra at Freeport have successfully secured development through upstream integration of buyers. By comparison, the commercial models of the second wave of US LNG projects are largely underdeveloped.

A merchant model is feasible if the developers have access to capital internally and can draw on a product marketing system. This has been the natural leaning of most oil & gas majors for decades, and it has reached natural gas and now LNG, such as Angola LNG and now LNG Canada. The declining role of monopoly importers and rise of the bunker market now make it natural for producers to take on those wholesale LNG functions, which require access to physical LNG.

Additionally, for pure financial reasons and sometimes to avoid share buy-backs, several oil & gas companies are actively seeking to reinvest cash flow in projects considered future-proof, like LNG. This means that they will in the first instance invest in projects where they already have strong positions.

Conversely, a reason why second wave US LNG projects appear to have seen little buyer interest to enter into traditional long-term contracts is that the buyers have already adjusted their purchasing practices to a shorter-term market. With global price formation and market liquidity, the additional logistics and management cost may far outweigh benefits of direct long-term sourcing from the US. Some buyers with low credit rating are in practice also excluded from the long-term market.

Many of the second wave US LNG projects therefore have clear challenges. Their claimed LNG agreements are in fact mostly non-bankable HOAs or SPAs with option-like conditions precedent. There has been a clear focus on staying a project developer in the US, and few have thus far had success in attracting downstream or oil & gas company investors. While some have been able to get minor funding and participation from equipment suppliers, this has not addressed the volume offtake challenge. The projects simply miss a leg.

As a last resort, and since the liquidity of the LNG market is growing rapidly, some financial institutions (or large traders) may be able to offer medium-term loans or financing securitized in offtake capacity, for example via Brent crude, the JKM, TTF or HH+plus indexes in structured deals. These are financing methods typical in supporting US shale oil & gas exploration and development and may have biased expectations of US project developers. The model is largely non-executable both for the size of LNG projects and the features of the global LNG marketplace.

These are the stark weaknesses for the majority of second wave US LNG projects. Is there an olive branch somewhere?

US vs. China and Europe

The official US energy policy under Donald Trump is one of securing global fossil fuel dominance. LNG exports are key in this effort, and pressure is routinely placed on buyers. Unfortunately, the administration seems to overplay the hand.

In the current trade war environment with the US, it appears unlikely that China will strategically support and advance new US-based LNG export projects when there are strong competitive alternatives available. The Chinese planning tradition and the legacy LNG coordination model also plays well together, which may instead benefit and lead to rapid development of new LNG projects in Canada, Russia, East Africa, Qatar and even the Timor Sea.

In Europe, pressure has been placed on several countries to block the construction of the Nordstream 2 gas pipeline from Russia to Germany and instead import more US LNG. The US arguments have at least nominally been accepted in Lithuania, Poland and Germany. Lithuania and Poland have already imported US LNG on a purely commercial basis. However, Poland (PniG) has recently entered into two long-term US LNG contracts for conditional start in 2023, which may be deemed strategic.

Germany is now expected to finally get its first LNG import terminal near Hamburg, but the key driver is in fact the local substitution of declining volumes of low-calorie Groningen natural gas with standard-quality gas. Since 2011, the EU has reached a level of pipeline interconnection that has made European gas supply very flexible and significant new supply quantities are not expected to be required until the middle and end of the decade.

End-game

The principle results of the 2019 LNG project beauty contests and FID processes seem largely pre-determined, and not involving any significant role for the second wave of US LNG projects.

- Some fully or substantially subscribed projects will be approved, such as Anadarko’s Mozambique LNG and Exxon’s Rovuma LNG, if costs are low enough.

- China (the three main players) will support selected projects outside of the US, and probably Canada, Russia and Indonesia/Timor and Australia, with maybe one project per year, and increasingly as co-venturer.

- Strategic oil & gas majors, including QatarGas and Novatek, will support own or suitable third-party liquefaction projects to build strong, tradable LNG portfolios and value chains.

In fact, as discussed, these oil & gas companies now make positive project FIDs based on global LNG portfolio sales instead of directly linking trains to long-term third-party offtake agreements. LNG Canada was effectively approved on this basis in 2018, and 2019 is now seen as the right FID time for several other projects. FID intent for 2019 has i.a. been signaled for QatarGas North Field 27 mtpa expansion, Novatek’s Actic-2 and BP’s Tortue FLNG.

A most extreme strategic and potentially market-unsettling variant is if Exxon and QatarGas make a positive FID on converting Golden Pass LNG in Texas to an export project in combination with QatarGas’ North Field expansion. There could also be a political rationale for such a solution that could come as a result of a series of non-US FIDs.

In sum, global potential LNG supply is significantly above projected requirements for many years ahead, even if exclusively supplied from the US or exclusively from outside of the US. Strategic players are likely to make FID decisions in 2019 that appear capable of ensuring a good supply-demand balance to even beyond 2030. These new LNG sources will to a significant degree be from resources outside of the US, benefitting from having locations closer to growth markets and the combination of new technology and recent cost reductions.

Impacts and caveats

Although the outlook for positive LNG FIDs in 2019 looks strong, oil price uncertainty and economic conditions can ultimately disturb the premises. If oil prices remain in the 50-70 USD/Bbl range it seems likely that the 2019 FID intent of oil & gas companies will be realized. The hope for a second large US LNG export wave would in this case effectively implode.

The largest losers from the increased oil & gas company focus on LNG matched by FIDs in 2019 are independent US LNG project developers. Most of them have no international presence, network, physical reach or effective backstop solution. They also have little money to try to patiently wait it out. Permit deadlines may also force the project to be abandoned (or “vacated” in FERC parlance.)

Even existing sites with trains in production or under construction may find it challenging to develop further trains if the number of positive 2019 FIDs becomes very large. The market has already been sluggish in the past two years.

The rationale for recently revised development plans with much smaller new trains at US LNG sites was to lower the investment and sales hurdle. What we see now, however, is that the trend to smaller trains is largely a reflection of substantially smaller interest in more US LNG. Demand for US LNG under long-term contract arrangements has effectively dried up. (It also appears that smaller and more trains lead to inefficiencies and extra costs.)

The picture can therefore be bleak for many independent US LNG developers. Despite otherwise well-crafted projects, many miss the commercial leg and may soon run out of money or face permit expiry. If they manage to hold on, new openings may realistically not appear until after 2022.

Hope beyond 2030

While the second wave of US LNG projects may end up much smaller than hoped for, the natural gas business is a long-term industry. Many projects have waited for realization far longer than 10 years and in any time perspective, the US will remain a major global LNG source.

Importantly, the expected disappointing outcomes for US LNG developers in 2019 should cause internal reassessments and lead to useful and significant rework of how these projects are structured and developed. The immediate effect, however, could be a concentration around existing projects and companies.

Looking further ahead, most forecasters expect global energy demand to level by 2035 or 2040. Natural gas and LNG will have enjoyed an over-proportional growth rate and market share increase to then. Assuming a 15 mtpa LNG growth rate continuing from 2023 to 2040, the 2019 FID project portfolio offers far greater volumes than what is required.

The expected trauma for many US LNG project developers in 2019 should not take attention away from the fact that the large medium-term overhang of LNG supply will instill buyer confidence and over time underpin a larger role and market share for LNG. The current situation with rapid structural changes in the market also highlight an urgent need to position projects and companies in an “end-game” LNG strategy framework if it has not already been done.

Copr. 2018 Eikland Energy AS, Asker, Norway

https://www.eiklandenergy.com – Telephone +47-99517555