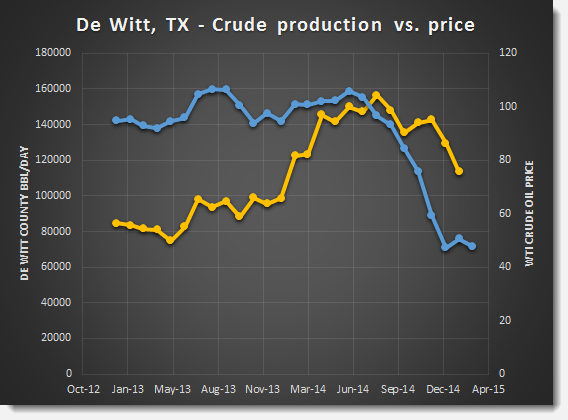

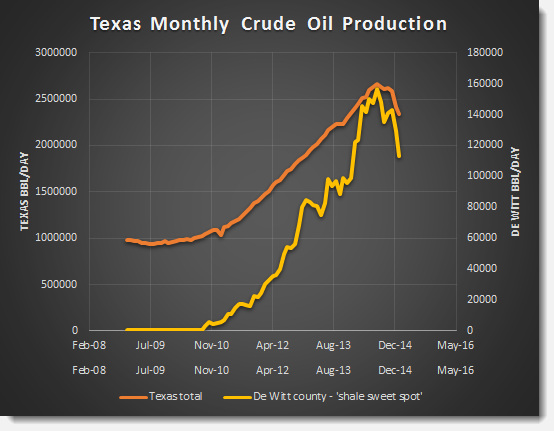

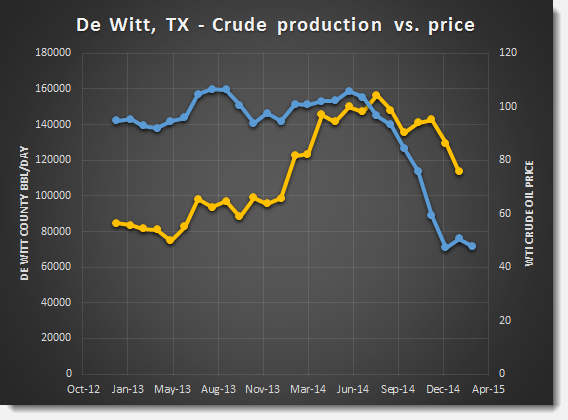

Crude oil prices have slowly increased over the past couple of months. The availability of solid US shale oil production data has been lacking, and many forecasts have maintained the incredible resilience of US shale oil economics. Data from both North Dakota and Texas now show an accelerating production decline. New data from Texas in particular, shows that growth actually stopped as early as August 2014. A shale oil “sweet spot”, De Witt county production is a leading indicator of the decline.

Our shale oil production forecasting model assuming a 60 USD/Bbl 2015 average price indicates a year-on-year shale oil production decline of about 0.5 mill. Bbl/day. Trends now indicates that the effect of the oil price reaching the low 40’s may have had a powerfully reinforcing effect on the decline rate. In fact, if the trend continues and drilling does not improve over the current 700 active oil rigs, the run-rate decline in shale oil production may lead to a drop quickly approaching 1 mill. Bbl/day.

Both North Dakota and Texas Data for March will be available by OPEC’s ministerial meeting on 5 June. Their strategy has worked, and it will take significant time for US action to recover. E&P companies have alienated suppliers, and both will be wary of expanding. There is now a potential for a “Pax OPEC” to be established, but this requires that OPEC are not be tempted to let prices again rise above 75 USD/Bbl.

OPEC has in fact little choice but to respect this new medium-term price balance. Their optimal strategy is to let prices slowly drift towards the long-run marginal cost as traditional supply sources decline. The market is therefore stuck between “the rock and a hard place” potentially for several years. This has powerful implications for E&P company strategies. US shale oil producers must now plan activities for the long run and not deplete their cash-generating sweet spots. Unless they have a very long perspective, large international E&P firms should probably not assume as Shell, an oil price of +90 USD/Bbl as basis for their acquisition of BG Group.

However, restlessness in the industry and management’s bias for action again seem to be leading to restructuring, mergers and acquisitions. The winning formula will be an integrated business model that is robust at moderate oil prices, not size and scale by itself. Just as Shell seems to think, our current favorites are in natural gas. However, if executed well, ConocoPhillips may be onto something very good too.