US shale oil could drop by 0.5 mill. Bbls/day in 2015

At current oil prices, there is momentum for stabilization and then contraction of US shale oil production through 2015 and beyond. The full output reduction reflecting the new price level is estimated to be 1.6 mill Bbls/day, but may take about three years to materialize. Reduced scale and operational efficiencies can accelerate adjustments.

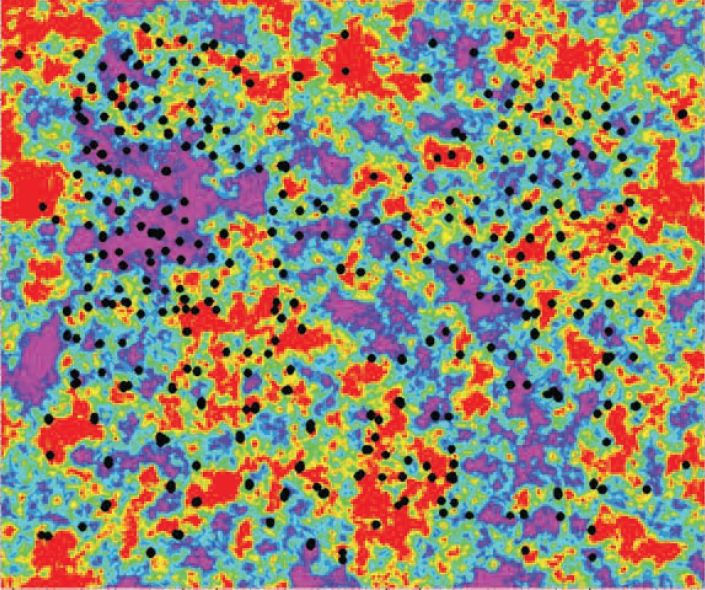

Well production declines, well inventory effects, operational lags and tactical dispositions distribute the effect of price changes on volume output over a long period. We expect total US shale oil production to continue to grow early in 2015. Subsequently there will be an accelerating production decline and our base case estimate for December 2015 production is 4.7 mill. Bbls/day. This is 0.5 mill. Bbls/day less than the December 2014 level (cfr. http://www.eia.gov/petroleum/drilling.)

The past rise in production can temporarily hide the onset of decline. The distributed lag effects of shale E&P are new and complicating factors in oil and gas forecasting, and for markets and oil prices. This has both strategic and methodological consequences. Our production forecast therefore reflects prices having temporarily been below 45 USD/Bbl (Brent), strongly influencing company planning for 2015. The forecast includes a base uncertainty range of ±0.2 mill. Bbls/day, which can increase to ±0.4 mill. Bbls/day should the price be significantly different from 60 USD/Bbl during 1H2015.

Documentation of emerging US shale oil production declines and trends may not be available to OPEC for their 5 June 2015 meeting. Barring major other changes in global oil supply and demand, this is likely to confirm OPEC’s resolve for the need to maintain or possibly increase their production. The growth of shale oil has become a problem for OPEC planning. Our analysis suggests that OPEC may find a more strongly applied explicit price target setting a more suitable steering mechanism.

The price drop has profoundly shaken the shale oil industry, but our results show there is reason to be very impressed by the resilience of shale operations to low oil prices. This particularly benefits companies with excellent resource quality and operations. The industry is fragmented and we believe that continued low oil prices and will give rise to significant M&A activity.

These issues are analyzed in five parts of the main report: UNCERTAINTY, FUNDAMENTALS, QUESTIONS, RESULTS and OUTLOOK.

For a presentation of the analysis, contact Kjell Eikland by tel. +47 995-17-555 email kjell.eikland@eiklandenergy.com.