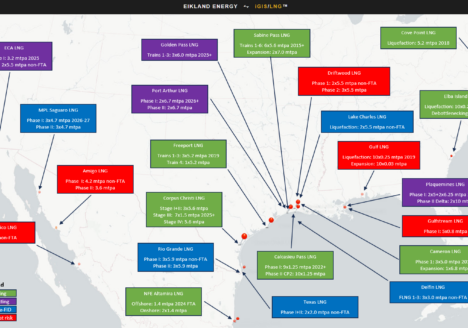

Eikland Energy Analysis: The U.S. DOE LNG export moratorium and a case for a 200 mtpa export ceiling

The announcement of a moratorium on the U.S. Department of Energy (DOE) awarding new LNG export permits (including extensions) on January 22, 2024, has stirred…